What’s Next for Web3

What a Year

This year has undoubtedly been one of the craziest years in Web3’s history, and it’s no secret that negative events have sucked up most of the oxygen in the news.

The collapse of FTX has caused significant damage to the perception and credibility of the industry, casting a shadow over its potential to build a user-owned internet. At times like this, it helps to take a step back and have some perspective on the actual progress and fundamentals of Web3.

In this piece, I attempt to share some of my thoughts on where we’re at and, more importantly, what’s next.

What Went Wrong

Custodial System Meltdowns: the worst thing that happened this year was the harm to investors caused by the meltdowns of custodial systems like FTX, 3AC, Celsius, BlockFi, and Voyager. These centralized financial institutions, many of which were unregulated companies located offshore, operated trading, lending, and speculation businesses that have given the industry a bad name. These events serve as a timely reminder for users in Web3 to move toward self-custody and DeFi to protect their assets. As the saying goes, “not your keys, not your crypto.”

Rug Pulls and Ponzi Schemes: we’ve also seen our fair share of rug pulls and Ponzi schemes that sell the promise of Web3 but don’t actually deliver any value. These bad actors started projects with the sole intention of making a lot of money very quickly through pumping and dumping and, sometimes, outright fraud. This is a recurring pattern in the hype cycles of new technologies, where opportunists take advantage of people’s lack of knowledge until they get up to speed and the industry matures. So remember to always do your own research.

What Went Right

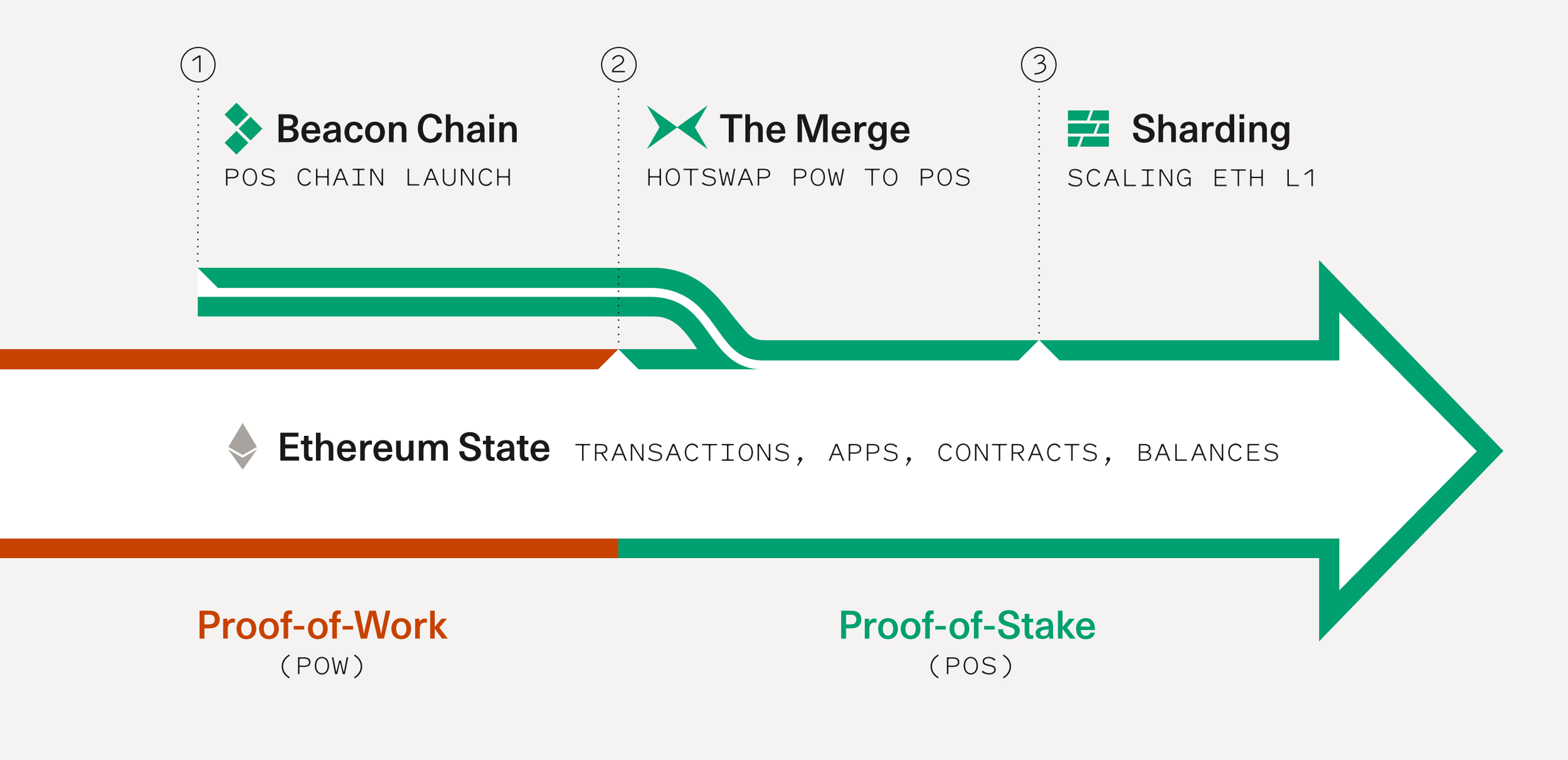

The Ethereum Merge: while much of the attention this year has been on the FTX’s of the world, some of the most significant and positive developments in Web3 have been quietly taking place too, such as Ethereum’s successful merge to Proof of Stake (PoS). This technical achievement has greatly reduced Ethereum’s energy consumption and ETH inflation, paving the way for future scalability upgrades. PoS systems, which require much less energy to operate, have the capability to make Web3 almost net-neutral in terms of carbon emissions, an important step for the industry and for the world.

Adoption of Stablecoins: another important step is the global adoption of stablecoins, which have been life-changing for a lot of people living in parts of the world with hyperinflation or shut out of their country’s financial systems. Stablecoins allow them to hedge against inflation and easily send and receive money. A prime example is the Reserve stablecoin, which enables users to exchange fiat currencies like Venezuelan bolivares for US dollars. Its use cases are growing from everyday purchases to family remittances, and many don’t even realize that it has anything to do with crypto.

The Road Ahead

Innovation in Layer 2s: Web3 is still in its early stages, and improvements to blockchain performance and scalability still need to happen before it reaches mainstream adoption. Emergent technologies like Layer 2s are starting to address these issues, with Ethereum continuing to provide security and decentralization as a Layer 1. Layer 2s will unlock a wide range of use cases, like video games that need to process thousands of microtransactions per second, media files that need to be shared cheaply, or financial transactions that need to happen instantly. While much of the discourse surrounding Layer 2s have focused on generalized rollups, which include Optimistic rollups in Optimism and Arbitrum and Zero-knowledge (ZK) rollups in zkSync and StarkWare, there are also a number of lesser-known Layer 2s like like Fuel, Scroll, and Polygon zkEVM that offer an improved developer experience, and Aztec and Immutable X that are specialized for individual use cases like privacy and gaming. These are the type of important developments that are happening behind the scenes without any coverage and will help drive the next wave of innovative Web3 applications.

Web2 Enterprise Adoption: a number of Web2 enterprises began to adopt Web3 technologies this year, and they will certainly not be the last. For instance, JPMorgan made a foreign exchange trade of tokenized fiat assets in collaboration with the Singapore central bank MAS and DBS bank. This is significant because the Forex market has more daily volume than the NYSE, TSE, and LSE combined. Starbucks is also putting their loyalty program on the blockchain, letting customers earn journey stamps to unlock unique benefits. Starbucks’ existing loyalty program already has ~27M active members, and 53% of all in-store spending comes from it. In the coming year, Instagram plans to fully integrate Web3 infrastructure to allow users to create and trade NFTs within the platform. As far as increasing the Total Addressable Market for Web3 go, Instagram could potentially onboard ~1.5 billion users. The amount of industries that Web3 technologies will disrupt is unimaginably large, and we can expect more Web2 enterprises to adopt it to reshape their businesses.

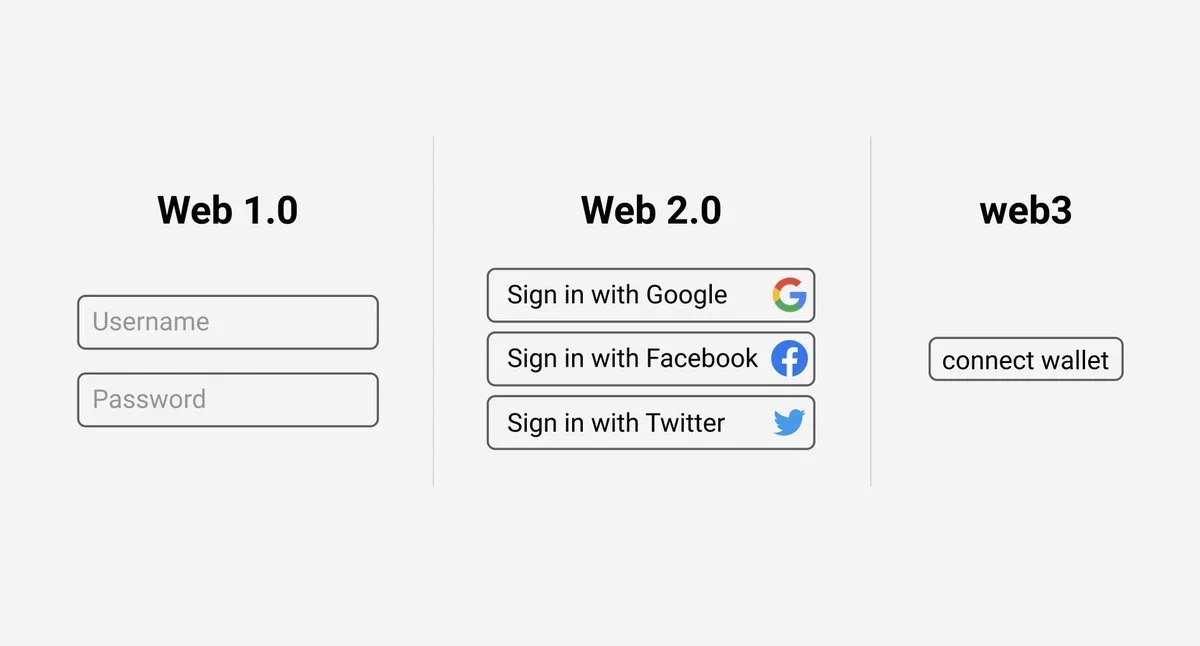

Adoption of Ethereum Single Sign-on: single sign-on using an Ethereum wallet allows users to easily and securely log in to websites without the need for multiple passwords and accounts. This is particularly relevant in today’s climate, where companies like Google, Facebook, and Twitter seem to own every aspect of our online lives, including our personal information, which is then sold to data collection companies and advertisers. Ethereum single sign-on solves this problem by letting users take control of their online identity and authentication. It has also enabled the rise of alternative social media platforms like Lens and Farcaster. In the future, more users will have an Ethereum wallet and use it to log in to the many websites they have an account on. When they visit any of these websites, they can simply click “connect wallet” to access their accounts, protecting their data and identity while making it easier to surf the internet. Web3 is building towards a future where technology, culture, and finance intersect, and it is these infrastructure developments that are preparing Web3 for the mainstream.

The Long Term View

Blockchains Can Remove Trusted Third Parties: the foundation of Web3 is built upon decentralized blockchains, which eliminates the need for trusted third parties and creates a more direct relationship between users and service providers. On a blockchain’s application layer, open-source software obviates the need for human-run institutions, whose lack of transparency can lead to the meltdowns we’ve recently seen. The emergence of decentralized blockchains and open-source software governed by communities is the most important software innovation of the last decade, and it is their increased transparency and built-in safeguards compared to current tech and financial systems that gives me so much confidence in the future of the industry.

Web3 Can Pressure Big Tech to Reform: as Web3 infrastructure continues to advance, the gap in user experience between self-custody and custodial systems will become smaller, and more users will feel comfortable taking control of their own assets and managing their own keys. Web3 developers are already building decentralized cloud computing services, search engines, and social networks. When Web3 becomes a credible alternative to Web2, Big Tech companies like Amazon will have to compete to access our data. The shift towards open-source and composable software development and away from centralized institutions will ultimately give the power back to us, the people.

Crypto Can Separate Money and State: the separation of church and state has ensured that governments can’t force or promote religion on people. However, governments can still enforce and promote fiat currencies, which are at the whims of Central Banks. Crypto offers a solution through the separation of money and state. For example, Bitcoin is not controlled by a centralized government and can’t be infinitely printed, and Bitcoin’s monetary policy is transparently set in its open-source software and regulated by its community of stakeholders. Crypto can bring a more fair and equal economic system to the world, but it will ultimately be our responsibility to self-custody our assets.

It’s Up to Us

There are still other bad actors to hold accountable, and the industry still has plenty of work ahead of itself to rebuild public trust. This is another difficult moment for Web3, where we can expect to see negative headlines for some time.

However, it’s also important to remember that the much more important underlying software innovation is happening too, with long-term builders continuing to deliver and mainstream adoption growing. This is what I remain so enthusiastic about.

The path to a user-owned internet was never going to be easy or straightforward, but the future is an unwritten story at this point. It’s up to us to make that happen.